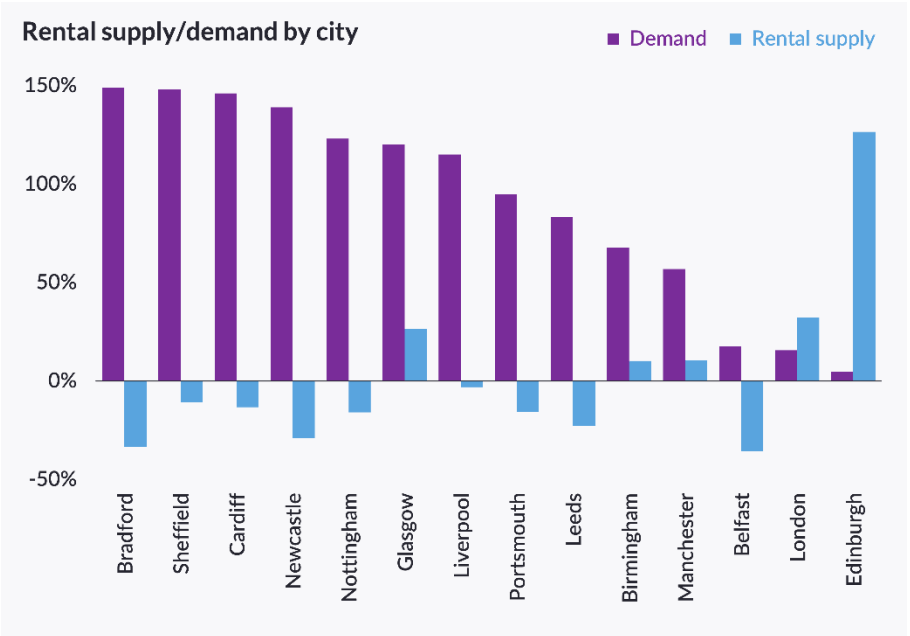

Experts from Hometrack and the leading UK real estate portal Zoopla united in the opinion that a two-speed rental market is emerging in the UK. Divergent trends drive this situation in supply and demand between London and the rest of the country. While available rental properties supply has increased in the capital, it is exposed to declined demand from international tourists and is affected by work-from-home policies. Edinburgh experience a sharp slowdown in rental growth. A shift in short to long term rents and policy changes also contribute to this trend.

At the same time, rental growth across the homeland counties, excluding London remains positive – varying from 1.5% in the West Midlands to 3.1% in Wales. Demand grows for suburban properties, as concerned renters try to escape London. Zoopla Research expects annual rental growth in the UK outside London to slow from +2.2% (end of July) to +1% by the end of 2020. The yearly decline in London rents can reach -5% by the same time.

Rental supply/demand is narrowing. Rental growth will start to slow as tenants benefit from a more comprehensive array of available properties. Levels of affordability within the rental sector have remained mostly unchanged in recent years, except for London. The capital is the least affordable destination, as the proportion of income needed to cover average monthly rent has fallen to 45% from 54% in September 2014. Nevertheless, it remains the most expensive region in the UK in which to rent a home.

Regions offer better business opportunities for letting business than the capital, shows research. For example, in Newcastle annual change in rents by the end of June was +3.4%, and Cardiff also showed a sustainable level of annual growth at around 3%.

Oracle Capital Advisors is an investment and real estate development consultancy specialising in residential and commercial property projects. We have helped private and corporate clients to complete deals collectively valued at £600+ million. Our team uses a uniquely proactive approach combining strategic advice and deal execution. We focus on gaining maximum return by utilising our unparalleled property investment and market knowledge.