Huw Pill, the Bank of England chief economist, said the “magnitude and duration of the transient inflation spike is proving greater than expected”. His notion supports the rational choice of investing in real estate.

Since the U-turn of the current government in planning reform, there is a slight probability, that supply of the new homes will rise as steadily as it was expected. House prices in Cambridge now are 16 times the average salary in Britain — up from four and a half times in 1997.

Knight Frank assessment says the number of international web users looking at lettings properties in August exceeded those UK-based for the first time since the start of 2020. Overseas students acting before the academic year and returning corporate tenants drive the demand as offices re-open. However, the increase in supply does not compensate for changes in the market, shows Zoopla data.

But since the Bank of England will probably not raise historically low-interest rates any time soon, there are ultra-low mortgage rates available on the financial side of the real estate market.

The demand and supply of houses in the UK

- No sign of abrupt decline in demand after the ending of the tapered stamp duty holiday in England and Northern Ireland

- Demand remains unusually high for this time of year, not balanced with a rise in levels of supply

- Imbalance between demand and supply continues to put upward pressure on pricing, although this may change by the end of the following year

- The market develops very quickly, with the time to sell a home averaging less than 30 days since May

- Buyer demand goes up in London, with a 14% rise in demand over the last month

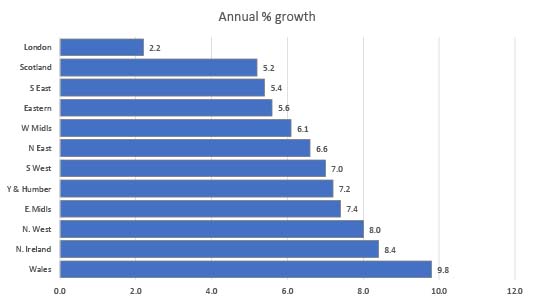

Current UK house price rose +6.1%. Demand for homes across the country increased almost 20% (YTD v 2020), while the net supply flow of new homes is -5% (YTD v 2020). There is a 25% rise in demand for houses across London and a 6% rise in demand for flats.

Annual growth of house prices in the UK Source: zoopla.co.uk

The supply in prime London real estate is short. At the same time, the number of new prospective buyers registering in Mayfair and Knightsbridge in September was 11% higher than the same month last year. Meanwhile, across the whole of PCL, there was an 8% decline, shows KnightFrank data.

Oracle Capital Advisors is an investment and real estate development consultancy. We specialise in residential and commercial property projects.