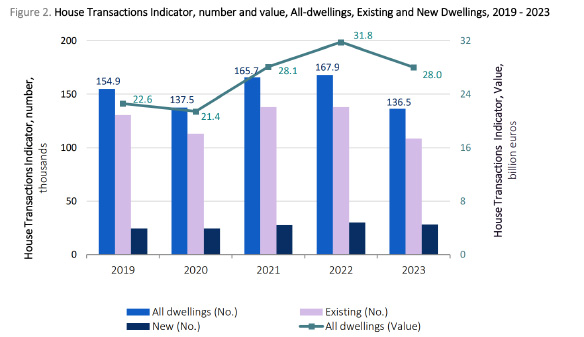

The Portuguese real estate market is starting to see the effect of the ECB’s tightening cycle that began in 2022. Despite an 8.2% growth in the House Price Index last year, the volume of transactions in 2023 fell by 19%, to 136,000 vs. 167,900 the year before, according to the INE, the National Statistics Office.

Over 60% of mortgages in Portugal are currently on variable rates or fixed for less than 12 months, hence the buyers are particularly sensitive to the rise in borrowing costs1.

International buyers

The share of international buyers has been steadily increasing over the last decade, accounting for about 7% of residential purchases last year. Following the Eurozone crisis of 2009-11, the government introduced fiscal and legal amendments including urban renovation schemes and changes in the urban lease laws to attract investors and developers. The Non-Habitual Residents Tax Regime and Residence Permit for Investment activity (“Golden Visa”) greatly contributed to a larger mix of overseas buyers, mainly the French, the British and the Brazilians2.

To qualify, buyers needed to invest at least €500,000 into real estate to receive EU residency for 5 years. Last year, around a third of transactions in Algarve were by foreign buyers, in Lisbon about a sixth – many of these on the higher-end. However, changes in the Golden visa regime in October 2023 mean that real estate or real estate related funds are no longer qualifying investments for residency.

Regional dynamics:

- Grande Lisboa area accounts for a third of all real estate transactions in the country. It has the highest prices, with median new houses fetching over €4000 per sqm; €6000 in prime areas such as Avenida da Liberdade, Príncipe Real and Chiado. The general lack of supply and delays in construction and permits have been driving forces in price dynamics.

- Norte – which includes Porto, the second largest city in Portugal, has been growing in importance. The establishment of a regional hub by Ryanair has helped the area to attract new institutional investors in both hospitality and office segments.

- Algarve – a part of so-called ‘Golden Triangle’ has been a key holiday attraction for many years. The recovery in hotel bookings since Covid has been less steep than expected, nonetheless this region accounts for most of the foreign real estate buyers. Prices vary tremendously with some of the high-end properties commanding valuation of €10,000 per sqm.

- The Azores – small but growing tourist destination, known for its wild nature and sustainable tourism. Last year, this region registered over €300m in real estate transactions targeting higher-end, affluent segment.

Rental yields

The rental market in Portugal is underdeveloped, the result of decades of rent controls and governments encouraging private home ownership. Recently, authorities have been making efforts to bring some flexibility and give more power to the landlords. According to CRBE, Lisbon’s city’s average is a 5.6% gross yield (6.25% for prime), but this can vary towards high single digits. The trend helped in part by unaffordability of buying a house for the young people in cities like Lisbon, who are often forced to live at home with the parents.

Conclusion:

Portuguese real estate dynamics offer a mixed picture. High interest rates after a 10-year period of 8% CAGR in house prices produced a big slowdown in volumes of sales last year. The changes in Golden visa regime may also affect marginal interest from overseas buyers in some of the in-demand areas such as Algarve.

Despite this, they are positive macro headwinds. Portugal’s economy is expected to produce a moderate growth of 2% real GDP this year, inflation is stabilising around 2.3% in March and the labour market is tight. Both Moody’s and S&P recently upgraded their sovereign ratings to A3 and A-. respectively.

The government is committed to fiscal discipline with budget surpluses projected through to 2028. Other structural factors impacting real estate such as delays with planning permission and lack of supply in particular segments of the market should underpin a positive but moderating growth in the asset class over the medium term.

1. According to the data from the European Mortgage Federation.

2. CBRE: ‘The Property Handbook on Portugal”, March 2024.