This article aims to provide some clarity on the proposed tax changes in the UK affecting non-domiciled persons. The reader may want to scroll to the diagrams below that show graphically criteria for the proposed tax changes. The first table is for Newly arriving residents who will benefit from the proposed Foreign Income and Gains (FIG) regime. The second table shows Transitional rules for current non-doms once the legislation comes in to force next April.

The results of local elections meant that about five hundred councillors all around the UK would change jobs. Labour are in, Conservatives are out. Come 5th of April 2025, big changes will come for the 68,000 UK non-doms, irrespective of which Party will win the General Election in November. Even though the non-doms have contributed £8.5bn in personal taxes in the 2021-22 fiscal year, the winds of politics today means that the ancien non-domicile regime is a particularly thorny subject for both Left and Right.

The Crown introduced the first income tax in the UK in 1798 to finance the war against Napoleon. Soon after, the 1803 Income Tax Act freed those subjects of Empire who lived abroad for more than six months a year from taxes. Thus, the non-dom was born.

Domicile is a particularly ‘nebulous’ term which is hard to explain to anyone outside of the UK. It is different from citizenship or residence and occupies its own niche. According to Henley & Partners, the citizenship experts, Domicile as a status is decided under general law, which means previous court rulings are the basis for its interpretation.

What is Domicile and why is it important in the UK?

Domicile simply determines how a person is taxed in the UK. If domiciled then, one is taxed in one way. If not domiciled, then in another. It is a fundamental concept under the UK tax law. A key provision of the domicile is that it is distinct from Residence or Citizenship, like in other countries. In fact, according to Henleys’, “domicile is a key function of the UK tax regime” and is a standalone concept. Anyone in the world has a domicile according to the UK. It is commonly derived from where you are born and where your father is born. It can also move with the person, when once decides to move from or into the UK permanently. Moving to the UK permanently is called “deemed domicile”. Under current rules, one is deemed domicile, if one has been resident in the UK for at least 15 out of previous 20 tax years.

Why is the concept of domicile unique? Other countries use residence to determine tax status. In the UK, there is a Statutory Residence Test, which is very ‘black and white’, a clear framework to determine UK residence status. Domicile is anything but clear.

UK’s domicile regime is distinct from other countries:

| Citizenship | Residence / Tax Residence | Domicile |

|---|---|---|

| Other countries, UK | Other countries, UK | UK |

Impact of domicile on UK tax status:

| STATUS | UK income | Non-UK income (remitted) |

Non-UK income (not remitted) |

|---|---|---|---|

| UK domiciled | Taxable | Taxable | Taxable |

| Non-domiciled | Taxable | Taxable | Non-taxable |

Source: Henley & Partners

New rules:

- From 6th of April 2025, the UK will eliminate the domicile regime.

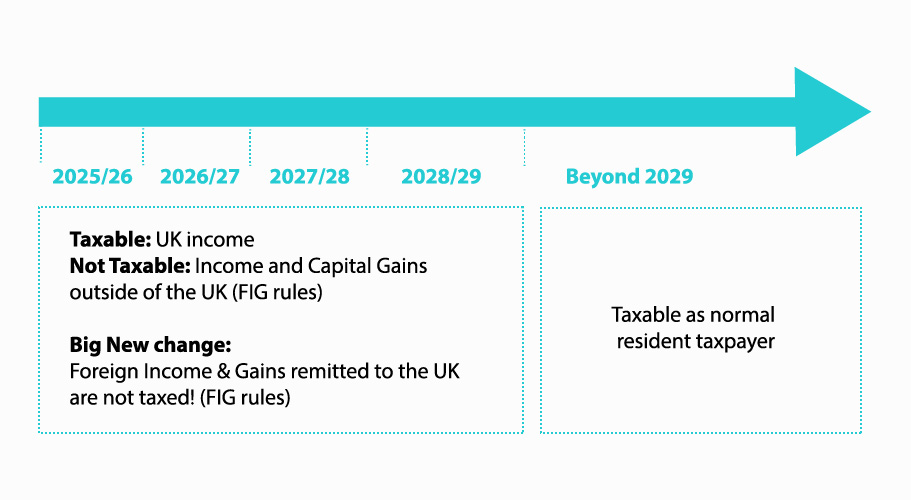

- New arriving residents can benefit from ‘Foreign Income Gains’ (FIG) regime for the first 4 years.

- Any existing non-dom who are in their first four years of UK residence, can benefit from the FIG regime from that date.

- The UK government set up Transitional rules for income earned before April 2025, remitted afterwards. More specifically:

- Transition rules apply for those who have been in the UK for more than 4 years by 5th of April 2025.

- Temporary Repatriation Facility (TRF) encourages remittance of foreign income into the UK.

- Trusts will be affected (trusts will be covered in the second part of this article)

- Inheritance Tax (IHT) rules for non-doms will change (this will be covered in the second part).

New Rules Timeline:

Transition Rules Timeline:

| STATUS | 2024/2025 | 2025/26 | 2026/27 | 2027/28 |

|---|---|---|---|---|

| Eligible for FIG rules (arrived 2022/23 or later) |

Existing remittance basis applies:

Taxable on UK income and remittances. Not Taxable on foreign income, not remitted. |

Transition Rules:

Taxable on UK income and remittances. Not Taxable on foreign income regardless of whether remitted or not. |

Fully taxable if arrived 2022/23

FIG rules for those arriving later, after 2024. |

Fully taxable if arrived 2023/24

FIG rules for those arriving later, after 2024. |

| Not eligible for FIG rules (arrived 2021/22 or earlier) |

Taxable on UK income and remittances.

Not Taxable on foreign income, not remitted. |

Taxable on UK income and remittances.

Taxable on 50% of foreign income regardless of whether remitted or not. |

Taxable on worldwide income. | Taxable on worldwide income |

| Unremitted income from 2024/25 or earlier | 12% tax rate under TRF | 12% tax rate under TRF |

Source: Henley & Partners

The new FIG regime

The idea behind the FIG regime is to simplify rules and to encourage inflow of capital in the UK, because under the current rules, individuals have no incentive to bring their UK income into the country, for they will be taxed on the remitted income. Under the proposed FIG rules, any new arrivals into the UK can bring their foreign income and gains into the country for 4 tax years starting from 2025/26 tax free. Another advantage is that it does not cost a penny to individuals to benefit from the scheme, subject to them making an annual claim. This is unlike the current remittance base charge. Another positive is the doing away with the requirement to track the on-shore/off-shore income lest the individual becomes liable for remitted income.

Yet another advantage is that the proposed FIG regime applies to both UK domicile and non-UK domicile persons. This means that anyone who returns to the UK after an extended leave away from the UK – 10 tax years – qualifies for the FIG regime. Under current rules, the full ‘look-back’ is much longer, 20 years. There are a few other conditions that mitigate current inflexible rules around who can claim non-dom status.

Drawbacks of the FIG regime:

After 4 years though “the party is over” and the person will start paying full taxes on their UK and non-UK income. This is a big change from the current regime where non-doms enjoy preferential status s for 15 years before becoming deemed domiciled.

If the individual leaves the country during the eligible 4-year period, the clock does not stop for them – they will lose the time abroad and will have to do with whatever is remaining on the clock when they return back in the UK. Also, split years of UK/non-UK residence are not likely to count in individual’s favour, so they may lose the ‘full’ years of the UK residence. In this respect, the FIG regime is tough on absences, and the devil is in the detail. At this stage the FIG regime is a proposal only and would be subject to change by either the Conservative party or the income Labour administration.

Similar to the current regime, individuals claiming under the FIG regime automatically lose both their tax-free allowance (£12,750 in the current year) and CGT exemption (currently £6,000).

Transitional rules:

Transitional rules apply to the following 3 categories:

- Persons who previously claimed remittance basis

- Persons not UK domiciled

- Persons not deemed UK domicile

Transitional rules and CGT rebasing:

One aspect of the new changes is an option to rebase CGT on the sale of assets.

Under a new regime, if these persons sell assets, after 5th of April 2025, they can opt to rebase asset values to the 5th of April 2019. Only assets held personally, not in a trust are eligible. For further information see the technical guidance released.

Temporary Repatriation Facility (TRF) @ 12%:

Existing non-doms who claim remittance basis can remit any accrued foreign income and gains for 2 tax years: 2025/26 and 2026/27 at a discounted tax rate of 12%. From 2027-27, remittance of foreign income and gains will be taxed under normal rates. One has to pay special attention to mixed fund ordering rules to determine the source of remitted funds.

A 50% reduction in tax for non-FIG eligible persons

Even if you are not eligible under the FIG rules, you can still claim a 50% reduction on the amount of foreign income and gains taxes in 2025/26 only (afterwards, normal rates of tax apply).

Conclusion:

There are significant changes coming to the UK tax regime as the domicile regime is scrapped in favour of a more modern tax/residence-based approach. At this stage the newly proposed rules are just that – proposals, some of the points could be amended or removed altogether. According to Henleys, if Labour wins, we can expect further tightening of rules around trusts and potentially scrapping of the 50% “discount” for the year 2025-26.

More importantly, many of the wealthiest can keep their houses and businesses in the UK, so long as they spend up to half of their time in the UK, without becoming a UK tax resident, just as they can in other tax jurisdictions.

Despite the changes, the year 2025 may not be that different from 1803 for some UK residents, after all.

Babur Yusupov,

Senior Investment Manager Oracle Capital Advisors

Legal Disclaimer

The information provided in this article is for informational purposes only and is not intended to be a substitute for professional tax advice. The content is provided “as is” without warranty of any kind, either express or implied. While every effort has been made to ensure the accuracy and completeness of the information, the rapidly changing nature of tax laws means that updates and amendments may occur after the time of publication. Therefore, we do not guarantee that the information is current or applicable to your specific situation.

This article does not constitute tax advice and should not be used as the basis for any decision or action that may affect your finances or legal position. We strongly advise readers to seek the guidance of a qualified tax specialist to discuss their individual circumstances before making any decisions based on the information provided herein. The authors, editors, and publishers of this article disclaim any liability for any loss or damage that may arise from reliance on the information contained in this article.