Is it still profitable to invest in whisky? Besides stockpiling high-value bottles of single malts, there are other ways to invest. You can purchase a dozen barrels of whisky which are aged, then sold for a profit. You can even buy a distillery.

That last option is exciting. Major producers focus on promoting whisky tourism because it increases spending on distilleries. Tourists from the US, Germany, India, China, and Japan visit Scottish distilleries more often than other nationalities.

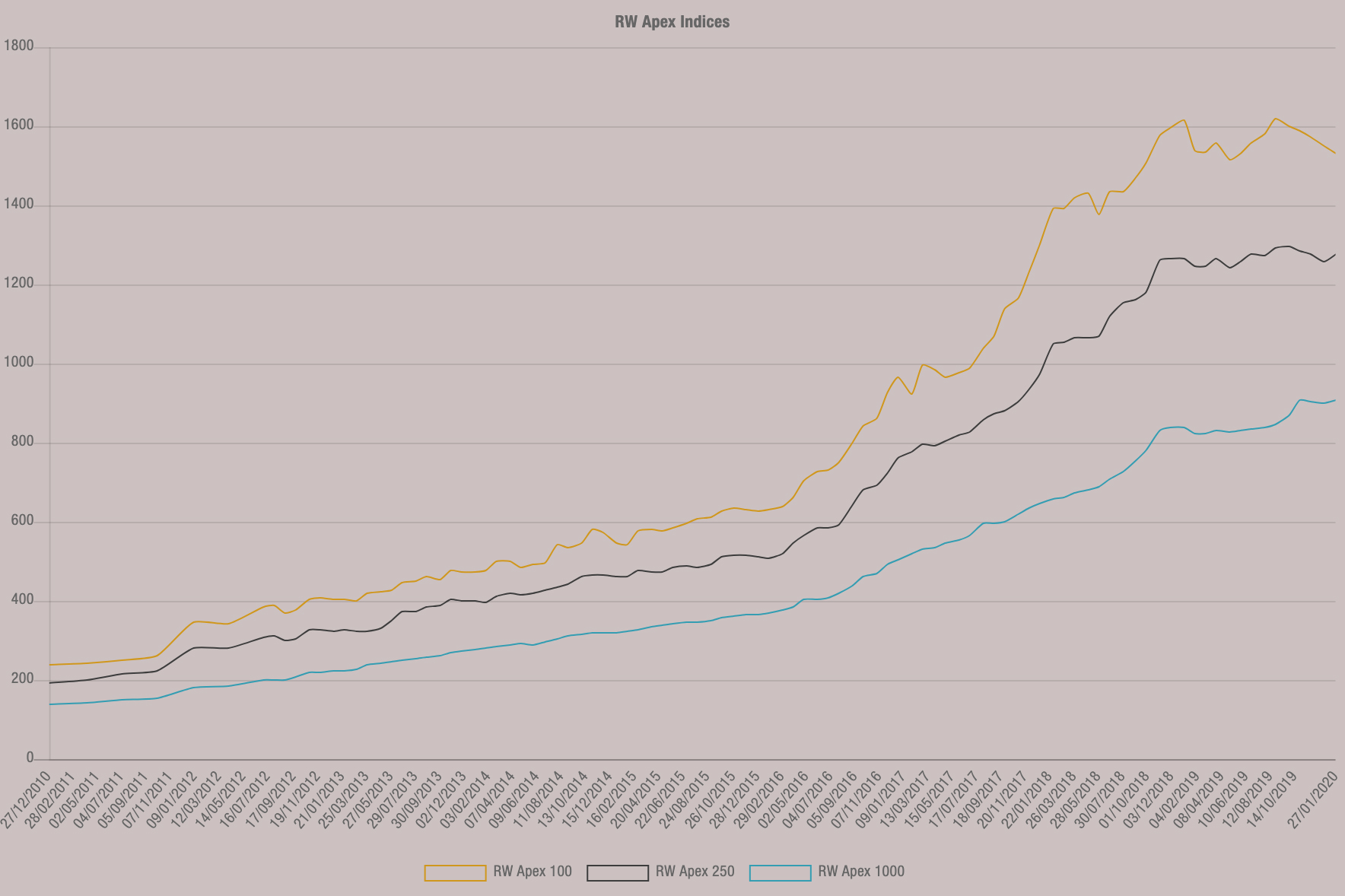

As you can see from RW indices on the graph below, the growth is steady and is far from reaching the plateau. Rare whisky index Apex 1000 reflects changes in the value of a collection of a thousand of the most sought after bottles of Single malt Scotch.

The primary driver of rare whisky sales is a traditional auction. The year 2000 indicated the point when the curious hobby of collecting rare bottles became a substantial alternative investment. In 2000 the auction in Glasgow first demonstrated the investment interest to whisky.

Auctioneers typically take around a quarter of the value of the whisky to sell them. Online houses take one-tenth but hardly get enough quality audiences. Whisky transportation and storage also cost money.

Instead of merging thyself into the laborious process of selection, and sales, investors may choose to buy a share in a fund. The specialised whisky fund is, for example, the Hong Kong-based Platinum Whisky Investment fund. The UK-based Oracle Paradise Wine Fund also has a significant collection of rare whiskies in its possession.

If you are not willing to take risks in funds, which are unprotected by the FSCS and are not FCA-regulated, you can invest in shares of companies that produce ordinary and not-so-ordinary drinks.

The major market makers are:

- Allied Blenders and Distillers Pvt. Ltd.

- Bacardi Global Brands Ltd.

- Brown-Forman Corp.

- Diageo Plc

- Pernod Ricard SA

- Suntory Holdings Ltd.

The global whisky market expected to grow up to USD 58.3 billion by the end of 2023. It may grow at a CAGR of 5.09% during 2020-2023. But the creme of the whisky market will always be a selection of rare bottles that will not be available anywhere else if you keep them to see how they soak value.

Oracle Capital Advisors can help you to manage your alternative investment in rare whisky by offering collectables from Oracle Paradis Wine Fund, the share of fund and alternative investment portfolio management services.