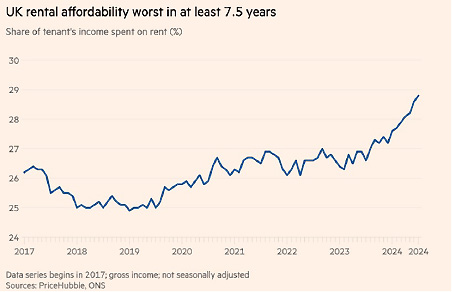

This month, the Financial Times reported that the tenants in the UK spend an average of 30% of their gross income on renting; the figure is 31.7% in London. The 30% threshold is significant because at this level housing is deemed to be ‘unaffordable’.

Rising house prices, high interest rates, changing demographics and lack of housing stock, including social housing, have squeezed buyer affordability. This puts further pressure on UK’s Private Rented Sector (PRS).

Build-to-Rent

Buld to Rent (BTR) offering could help alleviate the pressure on the rental sector. BTR properties are residential compounds that have been designated and built as rental properties rather than sales. In urban spaces these developments include amenities such as gyms, swimming pools, gardens, and co-working spaces to attract long-term residents. In rural communities, BTR homes called Single Family Housing (SFH), offer good quality new stock with the security of tenure.

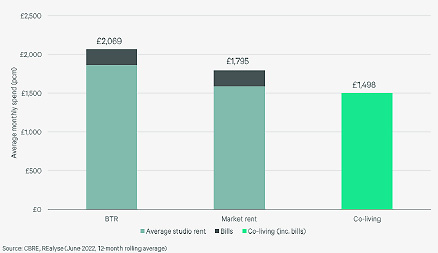

BTR are more expensive vs the average market rent (Cushman & Wakefield)

Amenity Lite BTR

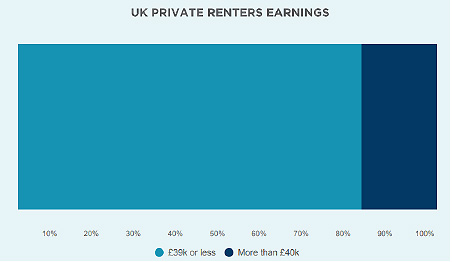

For comparison, the equivalent figure of rent-to-gross-income ratio in the US is 22.1%. This inequivalence in disposable incomes has implications on the type of private rented housing that is on the market. Given affordability constraints, the BTR segment in the UK offers less amenities than in markets such as the US where renters can offer to pay a premium. This subcategory is called Amenity lite BTR.

Rental affordability is a key criterion for the mass BTR product in the UK – 82% of UK renters earn <£39k (Cushman & Wakefield data)

The amenity lite BTR are smaller in size, and as result have an easier path to planning permission: no high-rise towers, no extensive facilities. The developments are not located in prime areas. The prevalence of amenity lite product means that the UK largely escaped the arms-race for the best facilities that has been a feature of the US BTR market. In the US, the high earners have more accommodation options so are more likely to switch. As a result, there has been an arms-race for the best BTR facilities as investors try to “future proof their multifamily assets” (1). It is not uncommon to see cinemas, libraries and a 24-hour concierge on some of the prime sites like the Emerson in LA or the Eugene in NY.

Whilst these may look outlandish for the UK market, the operators must not neglect the importance of community spaces as residents emphasise shared experience as part of co-living. A good ‘user experience’ should result in higher tenant retention rates for the operators.

Single Family Houses

Over 2/3rd of UK’s private renters live in the suburban or rural areas. Single Family Houses (SFH) product caters for this demographic and has been of the fastest rising subcategories within the BTR market, according to Cushman & Wakefield. With the average first-time buyer deposit in the UK at above £53,000, many young families are forced to continue renting for longer. SFH provide relatively upgraded facilities for families who need living space with private gardens and security of tenure. For these reasons SFH commands a premium compared the average PRS market. For investors, not only are the rental yields attractive, but the building risk is lower compared multi-storeyed developments in congested cities. Tenants in SFH require less amenity provisions than urban BTR schemes, with more emphasis on easy access to schools, GP surgeries and parks. The average tenant also stays longer reducing churn.

Institutional Capital

Like in the Co-living schemes, investments in BTR projects usually take the form of partnership between institutional capital and operators. For example, the Bath Junction development is a second venture between Watkin Jones developer and DWS asset management.

Conclusion

The positive tailwind for the BTR sector looks set to continue. The sector is one of the key viable alternatives to more of the population renting for longer and opting for more flexible living arrangements. The affordability stretch for renters in the UK means that amenity lite product will be the preferred option for developers. Within the BTR sector, the SFH subcategory should continue its strong momentum as higher proportion of families are forced to rent for longer. BTR operators must strike a balance between construction costs, operational efficiency and rental income, as well as delivering a return to their investors.

This is the second article in the series on Flexible living. You can find part one here.

(1) “Build to rent report – the future of the Private Rented Sector, Q2 2024”, Cushman & Wakefield