Real estate in Cyprus proved resilient in 2023 despite higher rates and geopolitical instability.

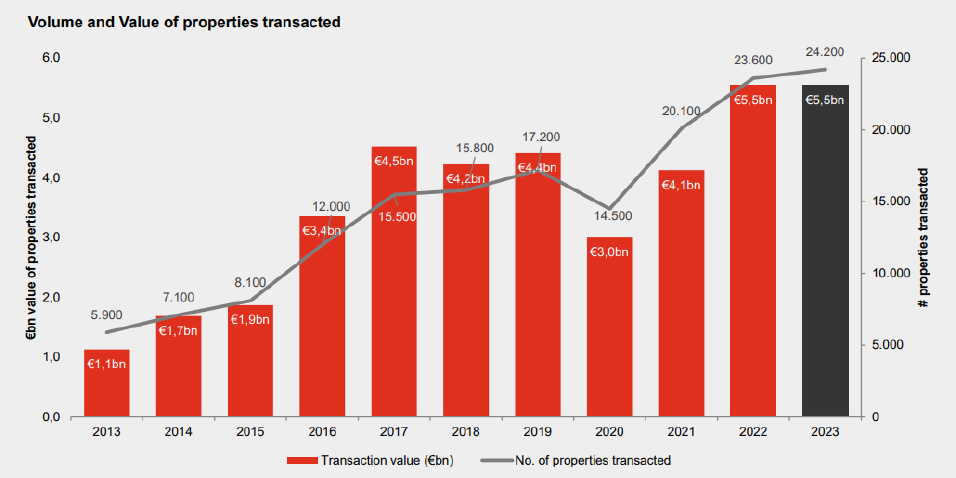

The total value of transactions remained at €5.5bn unchanged from a year before, following a large jump after the Ukraine war. Foreigners accounted for around 28% of the total volume of transactions. This represented a 16% increase versus the year before, driven by continuous relocation of foreign companies and staff to the island. The ‘Golden visa’ programme continues to attract foreigners who can receive EU residence following a €300,000 property purchase.

Figure 1. Volume and value of properties transacted.

Source: PwC, February 2024

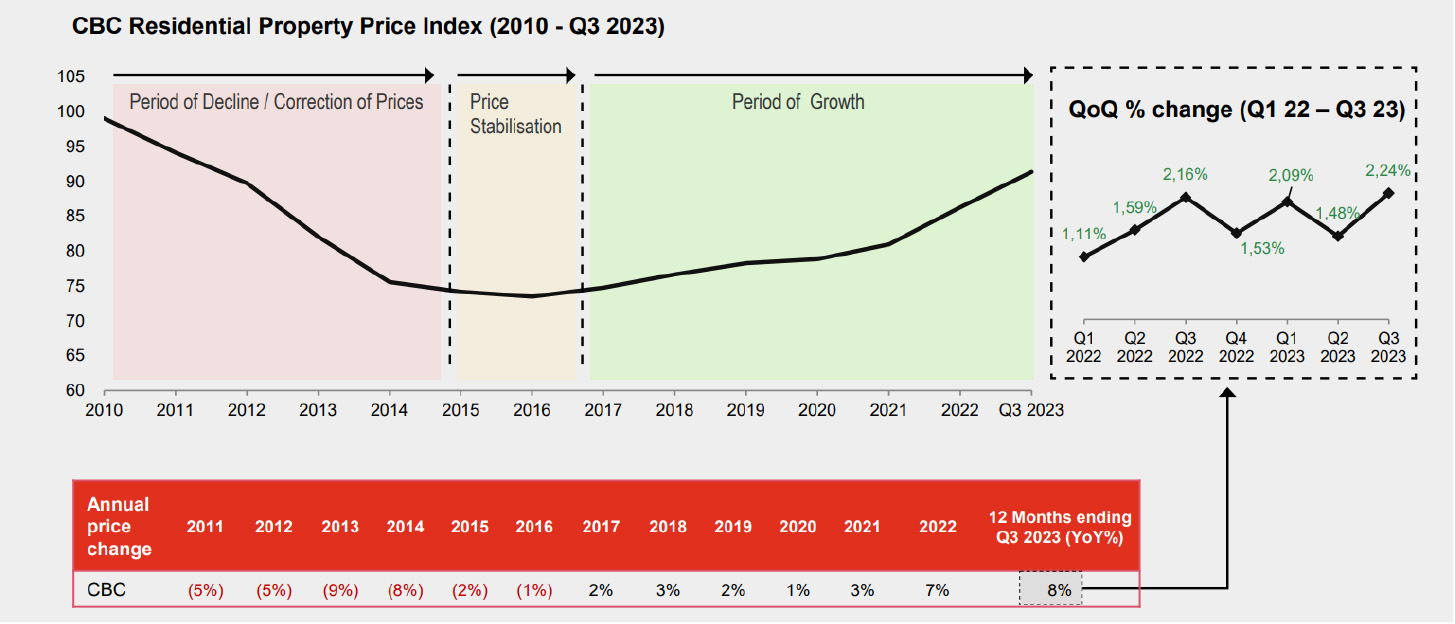

Apartments registered a 9.3% price rise in the 12 months ending in 2023, according to a joint report from RICS and KPMG. Houses rose by 5.5%, whilst offices registered a 2.5% increase. There has been a stable demand for land purchases, even though building permits increase slowed down last year. A large proportion of the price increases is attributed to high but moderating construction costs on the island (in line with overall inflation falling since a spike in 2022).

District Performance

- Larnaca: Experienced a significant rise in transaction volume (20%) and value (22%), driven by increased demand.

- Paphos: Also saw growth with a 3% increase in transaction volume and a 4% increase in value.

- Limassol: Despite an 8% drop in transaction value, it remained the leading district, accounting for 41% of the total transaction value.

- Nicosia and Famagusta: Both saw marginal declines in transaction values by 1% and 3% respectively.

High-end residential segment declines

Last year saw a drop in sales of luxury property, valued above €1.5 million with a 26% year-over-year decline in volumes. There were 164 transactions in total registering €440 million in sales. This trend explains the 8% fall in transactions value in Limassol – the district where most of the high-end transactions take place.

Historical context

The Real Estate as an asset class has shown continued recovery with the CBC Residential Property Price Index crossed back the 90th percentile of value before the Cypriot Financial Crisis of 2012-13.

Figure 2. CBC Residential Property Index (Q1 2010-Q3 2023)

Source: PwC, February 2024

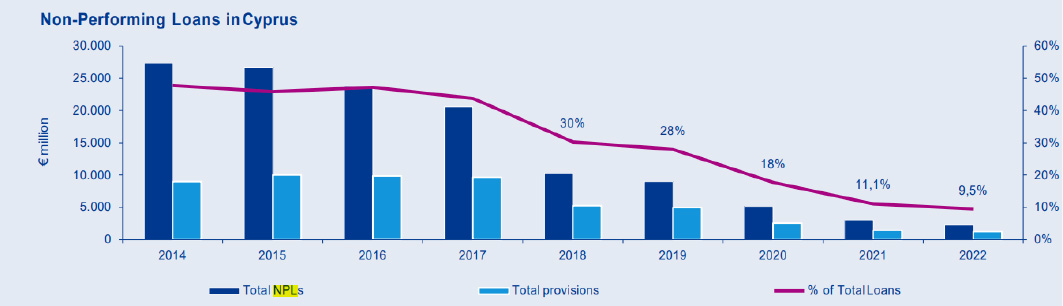

The island economy relies on tourism, real estate and financial services – the latter two have suffered the most from deleveraging post the great crisis. Fortunately, the proportion of Non-Performing Loans in the banking system has been continuously declining, aided by debt for asset swaps, write offs and repayments. The current real estate values appear to be built on a more sustainable footing.

Figure 3. Non-performing loans on Cyprus

Source: KPMG, May 2023

Conclusion

Contrary to the rest of the real estate universe, the Cypriot market has exhibited strong momentum in the last several years. The island remains a niche real estate destination, with a strong prevalence of foreign buyers. That said, domestic demand is growing, and a healthy, real GDP growth of 2.5% in 2023 puts the small country in the top of EU performers last year.

Coupled with moderating inflation, estimated by the European Commission to be 2.4% this year, and falling to 2.1% next year, the macroeconomic picture remains positive. There are several strategic infrastructure programmes which should benefit Cyprus.

The country’s Vision 2035 and EU’s Recovery Plan for Cyprus envision multi-billion investments into sustainable development, construction, agriculture and technology. As these high-level funds are deployed, opportunities should arise for further yield and capital appreciation plays in the real estate segments.