A long time ago my university friend was shocked to find a dead rodent in his freshly washed laundry. Perhaps this should not have come as a surprise, seeing as the shoebox-flat he rented was perched above a chip shop in Russell Square. For the most part, bad landlords and mouldy digs have been part and parcel of university experience. For the current students there is a new challenge: finding any place to live in. In March the student-to-bed ratio in London reached an-all time high of 3.6, a shortfall of 100,000 beds. The picture is only slightly better across the rest of the country with most university cities and towns experiencing housing shortages.

One problem is demand. There are more than 2.2m full-time university students in the UK today, 20% more than 10 years ago. Of those, the postgraduate segment grew at the highest rate, with three times as many students studying for master’s and PhD programmes as a decade ago. Many of these postgraduates are international students attracted to the UK’s one-year master’s programmes and graduate visas. The postgraduate courses help newer universities to level the playing field against the Russell Group institutions. When it comes to the latter, Chinese students account for nearly 43% of all international students at the top 24 universities. This is important because, according to Cushman & Wakefield (C&W), the Chinese cohort is likely to pay up for quality student housing 1.

Supply

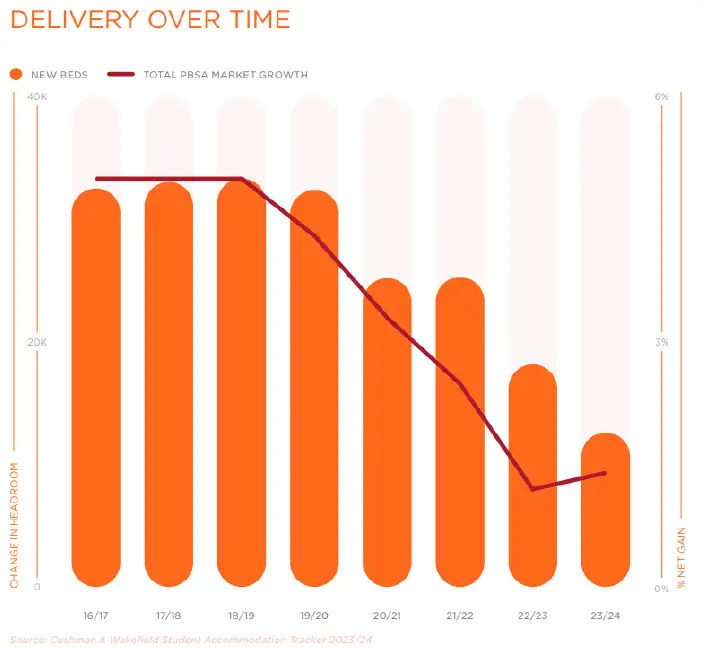

Against this, the net increase in student housing in 2023/24 was only 8,760 beds. During the last academic year, the total number of Purpose-Built Student Accommodation (PBSA) beds in the UK stood at 718,000.

The declining supply since 2020 reflects rising construction costs and issues with planning permission. As a result of shortages in supply, the PBSA rental growth in cities like Glasgow last year was between 19 and 42%. That said, the students are not willing to pay through the odds. There has been a trend in increases in communal space in newer PBSA properties as students demand better quality for the price.

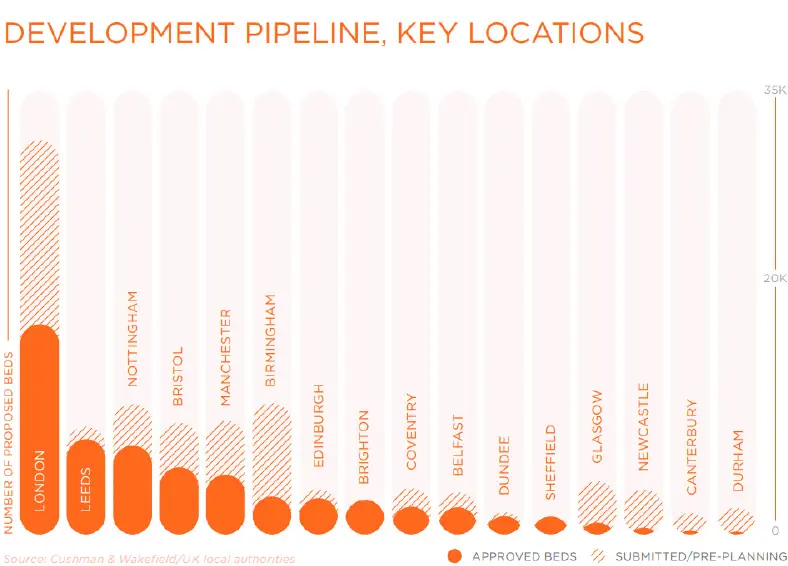

C&W estimates that over 131,000 beds are in development in the UK, of which 74,000 beds were approved (57%).

Investors

The PBSA institutional market is dominated by Singaporean money, and recently there has been an increase from the UK, North American and Middle Eastern institutions. Some of the notable deals was GIC and Greystar’s buyout of Student Roost in Q4 last year for £3.34bn. Other acquisitions last year were Metal Works in Bristol (KKR) and the Oaks in Coventry (Blackstone). This September, Blackstone secured a £2.6bn refinancing for its iQ Student Accommodation platform which operates 35,000 beds across UK.

Financing

Despite the rise in borrowing costs, the competition for the best-quality loans is still fervent, according to data from C&W. Last year generic prime margins contracted by 20bps to 170bps. In development financing, prime margins were estimated to be 285bps – a huge contraction over the last 5 years – driven by a growing appetite from UK institutional, UK banks, as well as non-bank capital.

C&W highlight that the cut-off LTV for senior leverage is at 55%, with the most competitively priced loans coming in below 50% LTV. Generally, these senior lenders expect a conservative stabilised interest coverage ratio of 1.2x. Debt funds are willing to stretch leverage to 75% and offer flexibility, such as interest-only periods, different repayment schedules, and lighter covenants.

As to the size of the ticket, there is a deeper bid for smaller, sub £100m loans as it avoids syndication.

| 2023 average yields on PBSA across segments (C&W data) |

|---|

| · 4.25% in Prime |

| · 5% in Subprime |

| · 7.25% in Secondary regions |

Challenges

Affordability has emerged as a critical issue in the PBSA sector. This is exacerbated by the fact that high-end PBSA developments, which command higher rents, are becoming more prevalent. This trend risks oversaturating the market with premium options while neglecting the need for more affordable housing solutions.

| Average Annual PBSA rent 2023/2024 | Location |

|---|---|

| £8,353.06 | Incl. London |

| £7,632.55 | Ex. London |

| 9% increase year-on-year |

Additionally, the changing demographic profile of students, including the growth in older postgraduate students and international students, further complicates the demand landscape, making it challenging for providers to meet diverse accommodation needs. Another risk is building cost inflation. Developers need to mitigate this through a nuanced appraisal of local realities. For example, if there is a gym owned by a large nationwide operator or university sports facilities close by, then this should be taken into account when constructing in-house sports facilities on the living site.

Policy risk from Local Planning Authorities (LPAs) could also hamper PBSA developments. Some LPAs have reportedly downplayed the structural need for PBSA facilities – many councils are resistant to having a large student population off-campus in residential neighbourhoods. Others have erratic policies: veering from light regulation, to suddenly demanding a lot more affordable housing or payments-in-lieu. National policy changes, such as those affecting international student visas, could impact future demand, particularly in less prestigious institutions. Finally, the government is close to issuing final recommendations for tall buildings (>11 metres) six years after the Grenfell fire. This should provide clarity on the collective cost to the industry when it comes fire and building safety.

Conclusion:

UK’s demand-supply imbalance underpins strong market fundamentals in PBSA. The countercyclical nature of higher education – more people choose further education during recessions – has so far stood the test of time. Investors can capitalise on the demand for mid-market and affordable accommodation, which is still underserved in many cities. There is potential for repurposing existing dwellings and integrating modern amenities to enhance living experience while controlling costs. To further broaden the investor base, developers can focus on integrating ESG (Environmental, Social and Governance) principles. This could attract sustainability-focused investors and align other stakeholders such as LPA and local communities.

Note: (1) ‘UK Student Accommodation Report, 2023, Cushman & Wakefield