There are economic trends ahead this year that will drive inflation, leading to a rise in the Bank of England base rate and inevitably translating into mortgage rates going up.

Rising mortgage rates will make buying a home more expensive monthly. Take into account that even finding a home to buy is not an easy task these days.

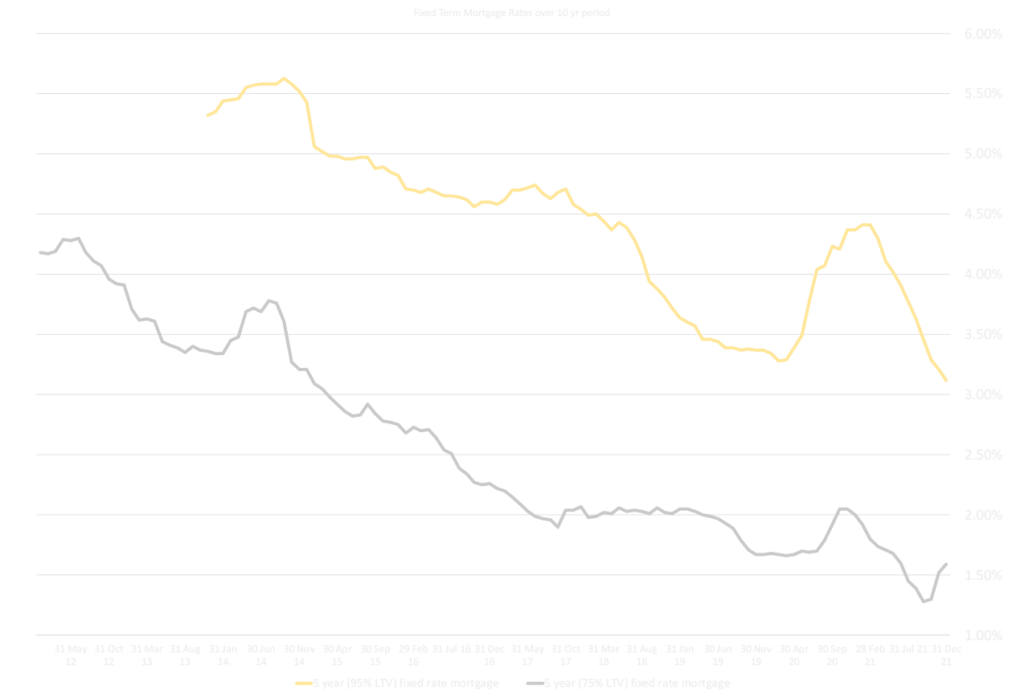

It is worth placing this home-buying enterprise into a longer-run context. Mortgage rates are currently at low levels. Lenders are competing for business so that rates will remain relatively low even with some quarter-point increases. You can fix rates at a very favourable position for a long time if you find a good deal.

Around three-quarters of owners have a fixed-rate mortgage deal so that they will be protected from any rate rises for some time.

Source: Bank of England

The government’s independent forecaster, the Office for Budget Responsibility (OBR), announced that if inflation rises by more than 5%, then a higher bank rate and more expensive mortgages, particularly in 2023, are more likely. The base rate acts as a benchmark for the cost of borrowing money. It is set by the Bank of England (BoE).

You could see an almost immediate change to your monthly payments if you currently have a tracker rate mortgage, as your rate directly correlates to interest rates. If you’re on a tracker or variable mortgage, you should start to look around to see if you can find a better option with a fixed mortgage, although you might have to pay an early redemption fee first. Suppose you are currently planning to apply for a mortgage. In that case, it makes sense to act sooner rather than later and obtain professional mortgage advice, as some mortgage lenders may allow the current low rates to be locked in at an early stage in the mortgage application process.

There are incredible deals on the mortgage market at the moment. For example, Kensington Mortgages together with the insurer Rothesay jointly offer the package, which allows borrowers with a 40 per cent deposit to fix their mortgage at an interest rate of 3.34 per cent for 40 years. Kensington is also offering shorter terms than 40 years, with rates of 3.16 per cent fixed for 35 years, 2.9 per cent for 30 years and 2.85 for 25 years for borrowers with 40 per cent deposits. A 15-year mortgage offers a rate of 2.83 per cent.

To use the advantage of the current unique situation before rates go up during 2022, we recommend you carefully assess your house loan situation and get professional advice.

Oracle Capital Advisors has reliable partner relations with numerous banks, funds, and the other UK, EU, and overseas financial institutions. The company finds and negotiates the most favourable financing terms for your next property investment enterprise in the United Kingdom.